Did you know? The Adams-Friendship Area School District’s 2025-26 property tax rate is down 7.2% or 42 cents from $5.84 to $5.42 per $1,000 of equalized property value. That is the second lowest tax rate of nine area school districts (second only to Wautoma) and is in the bottom 21% of all Wisconsin districts. However, residents’ final tax bills will depend on their home values.

This week’s #FinanceFridayAdamsFriendship is an overview of the district’s adopted budget. Future weeks will dive deeper into these topics:

Budget cuts: A-F cut roughly $600,000 from its budget by scrutinizing every line item.

Spending: A-F’s total general fund spending increased only 1.75%, demonstrating fiscal stewardship amid increases in salaries, health insurance and transportation.

Revenue limits: the state gave districts permission to collect $325 more per pupil, but shifted that burden onto local taxpayers by freezing total state equalization aid.

State aid: A-F’s general state aid is down roughly 7.8% or more than $417,000, shifting additional burden to local taxpayers.

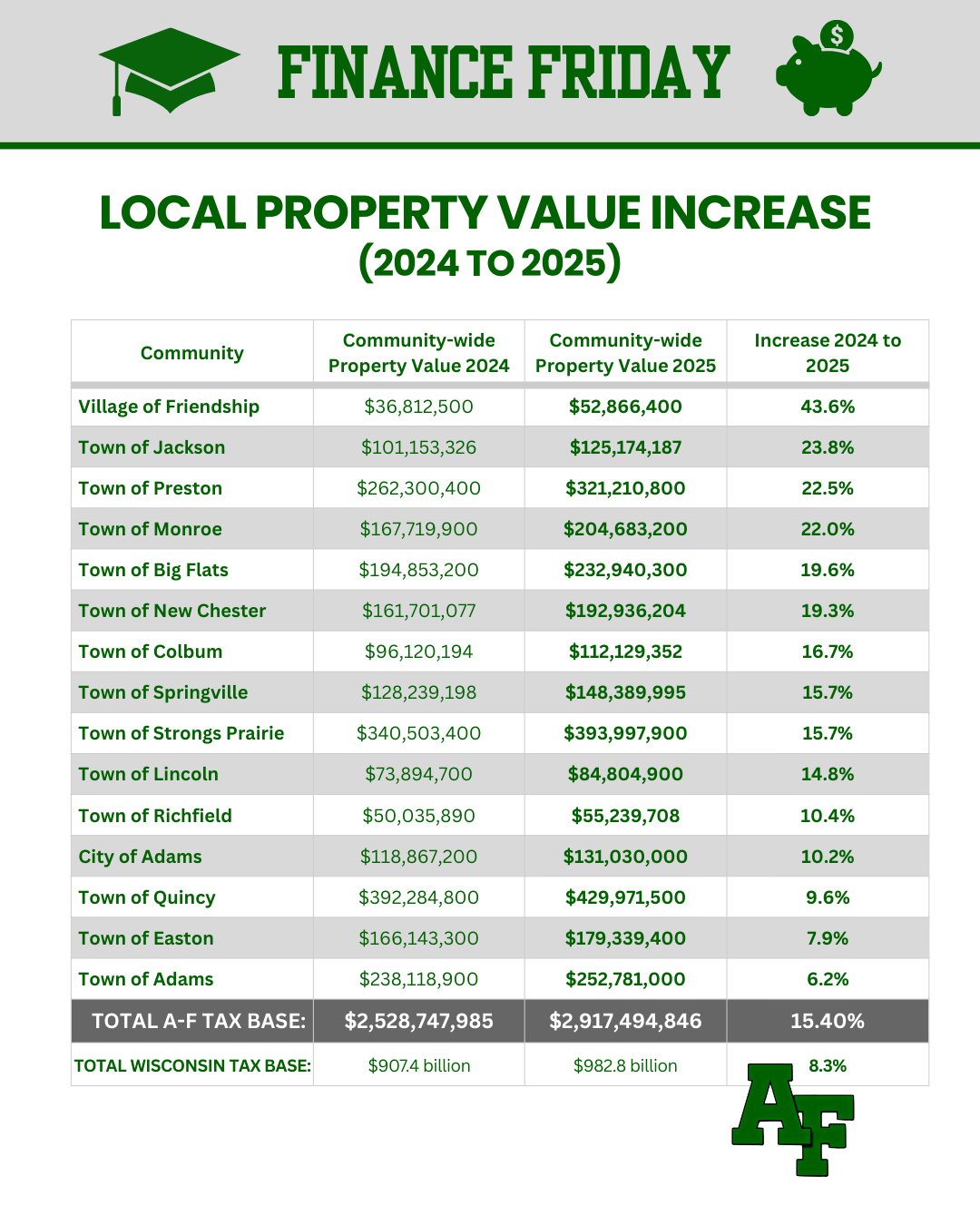

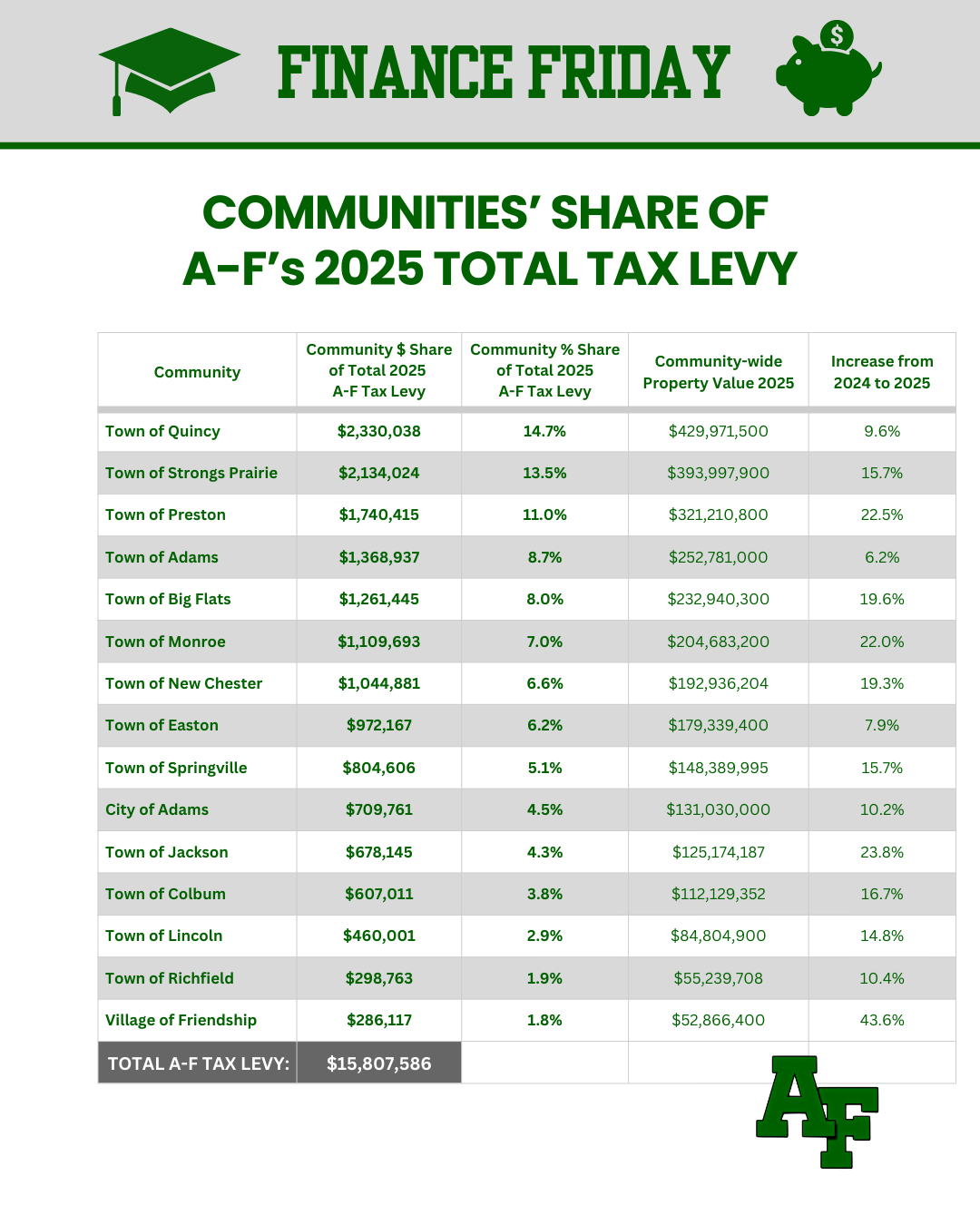

Property values: A-F is a “land-wealthy, income-poor” district in which property values are rising faster than household incomes. A-F’s total tax base rose 15.4%, nearly double the 8% statewide increase. That means if your home was reassessed and its value increased substantially, your taxes may go up even though A-F’s tax rate dropped 42 cents.

NEXT WEEK: property value changes in our 15 district municipalities

#WeAreAdamsFriendship